06 Jun

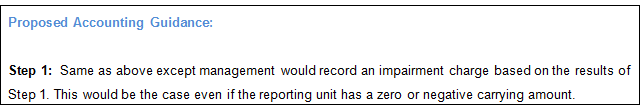

The FASB is considering new guidance that would simplify goodwill impairment testing for all companies. A single step test would be used to determine if goodwill is impaired rather than having to perform a complex two-step test. Several years ago the Financial Accounting Standards Board (“FASB”) simplified the goodwill impairment test for private companies by only requiring a one-step impairment test. They are now considering similar changes for public companies and not-for-profits.

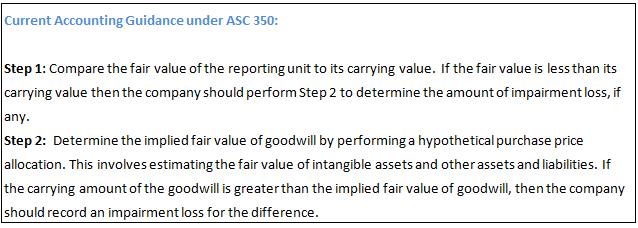

Accounting Standards Codification (“ASC”) 350 Intangibles-Goodwill and Other, gives companies the option of performing a qualitative assessment to determine if the two-step quantitative test is necessary. Based on this assessment, management decides if it’s more likely than not that the fair value of the reporting unit is less than its carrying amount. If so, then they perform the following steps:

The proposed changes are currently open for comment by the FASB through July 11, 2016. If they are accepted, the changes will be adopted prospectively to goodwill impairment tests. You can view the current FASB Exposure Draft related to the proposed changes here.

You may remember the FASB made the goodwill impairment test easier for private companies in 2014 when they allowed them the alternative of amortizing goodwill on a straight-line basis instead of doing an annual impairment test. The FASB is also considering making changes to the subsequent accounting for goodwill for public and not-for-profit companies as well. You can keep track of the status of these changes at this link to the FASB Website.